What a Government Shutdown Really Means for the Housing Market in 2025

When people hear “government shutdown,” they often think of politics in Washington—but the effects go far beyond that. A shutdown can delay home purchases, slow mortgage approvals, impact VA loans for veterans, and create uncertainty in the real estate market.

If you're thinking about buying, selling, or investing in a home in 2025—especially in Texas or military-heavy areas like San Antonio—this guide explains what you really need to know.

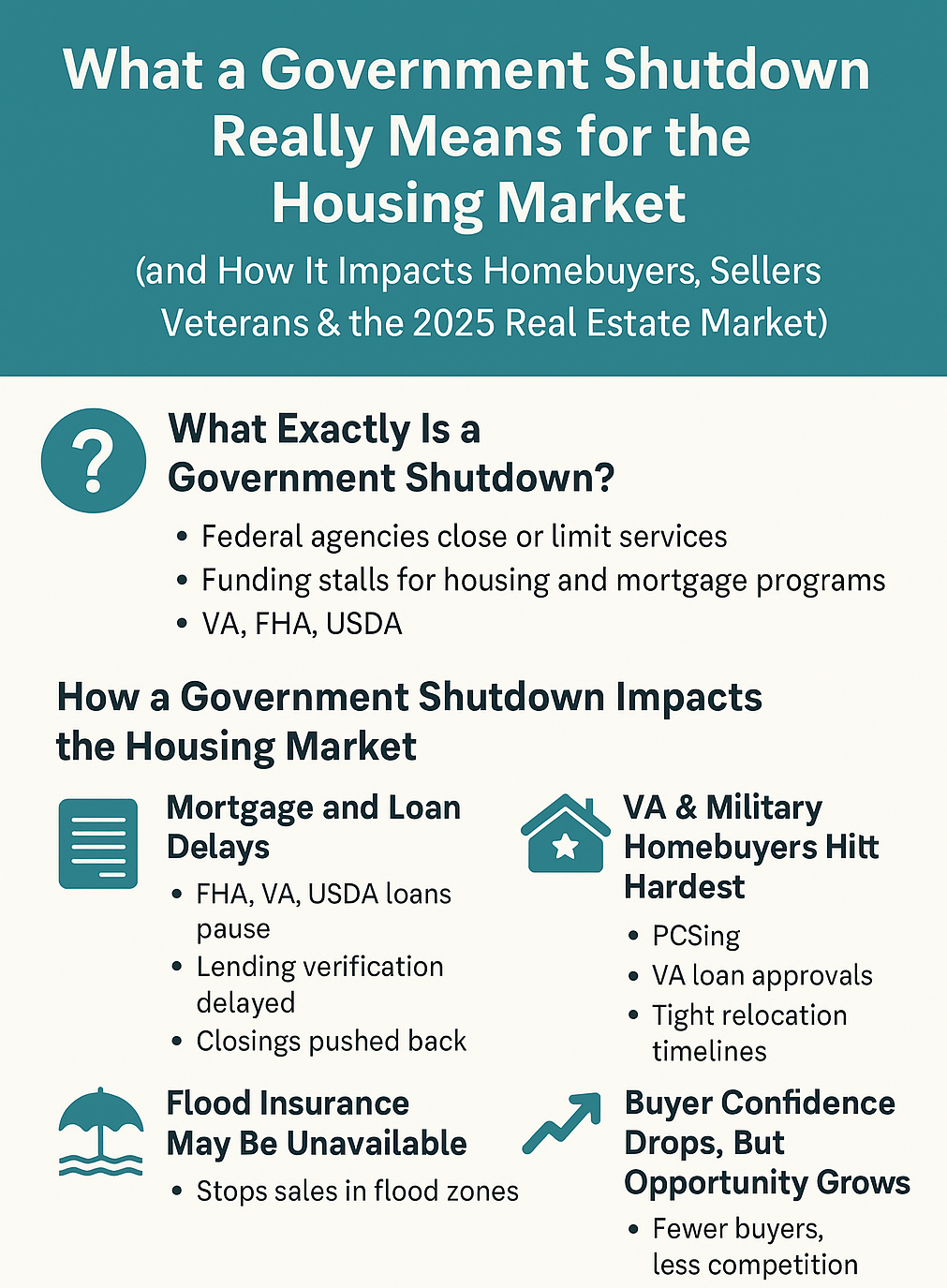

✅ What Exactly Is a Government Shutdown?

A government shutdown happens when Congress fails to approve federal funding. When that happens, many government agencies either close or operate with limited staff.

This matters because housing and mortgages rely heavily on federal agencies, including:

- VA (Veterans Affairs) – approves VA home loans

- FHA & HUD – insure government-backed loans

- USDA Rural Development – processes rural home loans

- IRS – provides income and tax verification for lenders

- National Flood Insurance Program (NFIP) – required for homes in flood zones

When these departments slow down or pause, the entire home-buying process can experience delays.

🛑 How a Government Shutdown Impacts the Housing Market

- Mortgage and Loan Delays

- FHA, VA, and USDA loans may take longer to process or completely pause.

- Lenders struggle to get income and tax transcripts from the IRS, slowing all loan types—including conventional loans.

- Buyers under contract may face delayed closing dates.

Long-tail keyword example: “Will a government shutdown delay my VA home loan approval?”

- VA & Military Homebuyers Are Hit Hardest

For active-duty military families PCSing (Permanent Change of Station) and veterans using VA loans, a shutdown may mean:

- Slower Certificate of Eligibility (COE) approvals

- Delayed appraisals

- Longer underwriting times

- Added stress during relocation timelines

This is especially important in military cities like San Antonio, New Braunfels, and Cibolo.

- Flood Insurance May Be Unavailable

Homes in FEMA flood zones require flood insurance to close. During a shutdown, NFIP may not issue new policies or renewals.

Result: Even if the buyer is ready and the lender is ready—you cannot close without flood insurance.

- Buyer Confidence Drops, But Opportunity Grows

- Some buyers hit pause due to uncertainty.

- Fewer buyers = less competition and better leverage for serious buyers and investors.

- If a shutdown lowers interest rates (due to market uncertainty), buyers could benefit.

🛠 What Homebuyers and Sellers Can Do to Stay Ahead

✅ For Buyers:

✔ Get pre-approved early (not just pre-qualified)

✔ Ask your lender if they have backup plans if IRS/VA systems go down

✔ Build extra time into your closing date

✔ If using a VA, FHA, or USDA loan—stay in close communication with your lender and agent

✅ For Sellers:

✔ Be prepared for possible loan or appraisal delays

✔ Consider accepting conventional or cash offers if timing is critical

✔ Work with an agent who understands government-backed loan timelines

✅ For Military & Veteran Buyers:

✔ Request your Certificate of Eligibility (COE) now—before a shutdown hits

✔ Use a lender experienced in VA loans who can issue approvals with minimal disruption

✔ Talk to your agent about PCS timing, temporary housing, and backup plans

📉 Will a Government Shutdown Cause Home Prices to Drop?

Not immediately. Here's what may happen depending on how long a shutdown lasts:

|

Shutdown Duration |

Market Impact |

|

1–2 weeks |

Minimal impact – slight delays only |

|

3–6 weeks |

Slower closings, buyer hesitation |

|

6+ weeks |

Price reductions in certain markets, increased cancellations |

🧭 Final Thoughts: Should You Pause Your Real Estate Plans?

No—just plan smarter.

A government shutdown doesn't stop the housing market, but it does slow it down. With the right agent, lender, and preparation, you can still buy or sell successfully.

📲 Need Guidance or Have VA Loan Questions?

Whether you're a first-time buyer, veteran, investor, or relocating military family—I'm here to help you navigate every step.

Categories

Recent Posts