The Cost of Living in Texas vs. Renting Anywhere Else: Why Buying Makes More Sense

If you're a renter thinking about making the leap into homeownership, you're not alone. Many Texans — especially military families relocating on PCS orders, first-time home buyers, and longtime renters — are asking the same question: “Is it really cheaper to buy than to rent in Texas?”

Let’s break it down — not just in dollars, but in long-term value, benefits, and opportunities.

💸 Renting: The Ongoing Expense That Builds Nothing

Renting can feel convenient, especially if you move often or don’t want to deal with maintenance. But here’s the truth:

-

You’re paying someone else’s mortgage — just not your own.

-

Rent prices in Texas have steadily risen, especially in growing cities like San Antonio, Austin, and Dallas.

-

You have zero control over future increases — landlords can and do raise rents yearly.

-

There's no return on your investment — your monthly payments disappear into someone else’s pocket.

Example:

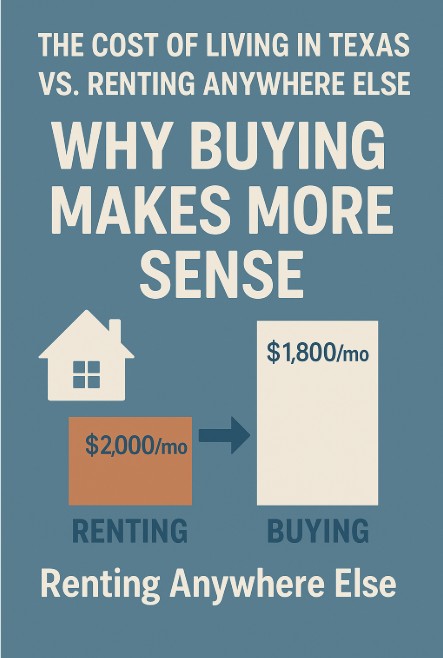

Let’s say you rent a 3-bedroom home in San Antonio for $2,000/month. That’s $24,000 per year, or $120,000 over just 5 years — money you’ll never get back.

🏠 Buying in Texas: Affordable, Smart, and Full of Perks

Texas has consistently been one of the most affordable states for homeownership, especially when compared to large coastal cities.

What Makes Buying in Texas a Great Option?

-

No state income tax, which means more money in your pocket.

-

Lower property taxes than national averages in many counties.

-

Plenty of VA loan options for military families — $0 down and no PMI in most cases.

-

Homes that are more affordable per square foot compared to rental properties.

-

Equity building — every mortgage payment helps grow your wealth.

-

Stable monthly payments with a fixed-rate mortgage — no surprise rent hikes.

📍 A Texas-Specific Advantage for Military & First-Time Buyers

Texas is home to several major military bases, including Fort Sam Houston, Lackland AFB, and Randolph AFB. If you’re PCSing to San Antonio or elsewhere in Texas:

-

VA loans make it easier to buy with no down payment.

-

You can often buy a home for less than the cost of renting a similar property.

-

You’ll find military-friendly communities with nearby services, top-rated schools, and support networks.

💡 Real-Life Math: Renting vs. Buying

| Scenario | Monthly Cost | Annual Cost | 5-Year Total |

|---|---|---|---|

| Renting (3-bed home) | $2,000 | $24,000 | $120,000 |

| Owning (VA Loan, 3-bed) | $1,800 (mortgage + taxes) | $21,600 | $108,000 (minus equity gained) |

Even if the monthly costs look similar, homeownership gives you equity, appreciation, and tax benefits — renting gives you none of that.

✅ Final Thoughts: Renting Is Temporary. Buying Is Transformational.

Whether you’re:

-

A first-time buyer trying to break the rent cycle

-

A military family planning your next PCS move

-

Or someone who’s tired of watching rent prices climb…

Texas is one of the best places in the country to buy a home — especially right now.

Let’s chat about your goals, your timeline, and how I can help you make the leap. As a local real estate expert who specializes in first-time buyers, military families, and VA loans, I’m here to walk you through every step of the journey.

📞 Ready to stop renting and start owning?

Contact me today to schedule a no-pressure consultation. Let’s run the numbers together and explore what homeownership looks like for you in Texas.

Categories

Recent Posts