Understanding the VA Funding Fee: What Every Veteran Needs to Know Before Buying or Refinancing

For Veterans, active-duty service members, and surviving spouses, the VA loan is one of the most powerful home financing benefits available. No down payment, competitive rates, and no monthly mortgage insurance make it an incredible tool for building long-term wealth through homeownership.

But there’s one part of the VA loan program that many buyers still have questions about:

the VA Funding Fee.

Below is a clear, simple breakdown of what the funding fee is, who pays it, who doesn’t have to pay it, and how it affects your home purchase or refinance.

What Is the VA Funding Fee?

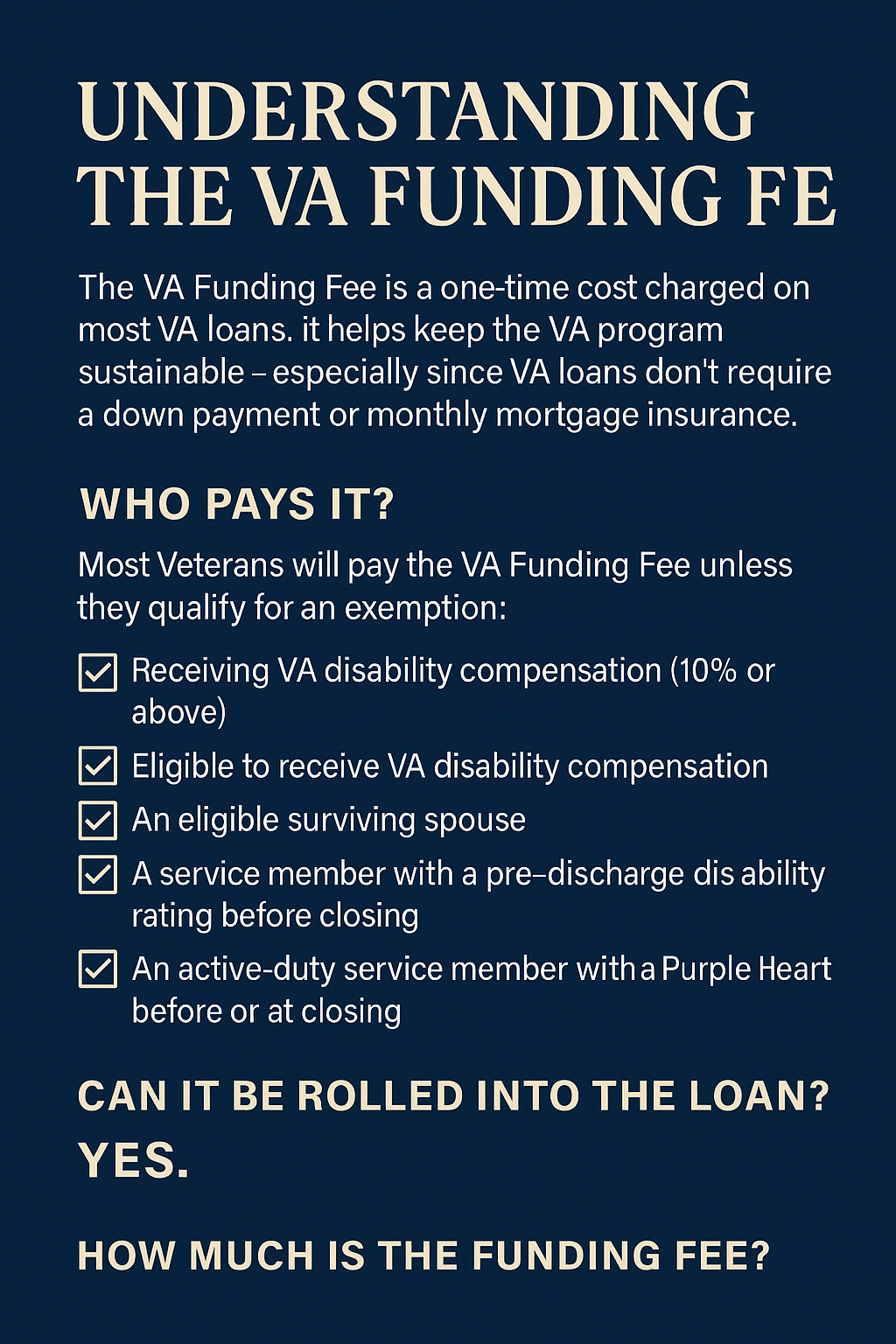

The VA Funding Fee is a one-time cost charged on most VA loans.

Its purpose is simple: it helps keep the VA loan program sustainable and available for future generations of Veterans—especially since the program offers zero down payment options and no mortgage insurance.

Unlike other closing costs, the VA Funding Fee is unique to the VA loan.

Who Has to Pay the Funding Fee?

Most Veterans will pay the VA Funding Fee unless they qualify for an exemption.

You’re exempt from paying the fee if you fall into any of these categories:

- Receiving VA disability compensation (10% or above)

- Eligible to receive disability compensation, even if you’re not currently receiving it

- An eligible surviving spouse of a service member

- A service member with a pre-discharge disability rating prior to closing

- Active-duty member with a Purple Heart before or at closing

These exemptions are especially important today, as many Veterans are considering home purchases or refinancing while rates shift and become more favorable.

Can the VA Funding Fee Be Rolled Into the Loan?

Absolutely.

For both VA purchase loans and VA refinance loans (IRRRL or cash-out), the funding fee can be added directly to your total loan amount.

This keeps your upfront out-of-pocket costs low—often making homeownership more accessible for those transitioning out of service or relocating for a PCS.

How Much Is the Funding Fee?

The exact funding fee depends on several factors:

- Purchase vs. Refinance

Purchase and refinance loans have different funding fee structures.

- Down Payment Amount

The more you put down, the lower the fee can be (and sometimes significantly).

- First-Time Use vs. Subsequent Use

If you’ve used your VA loan benefit before, your funding fee may be higher on future loans.

This is where personalized guidance matters. No two VA buyers are the same, and your funding fee amount can vary based on your specific situation.

Why the Funding Fee Matters

Even though the VA Funding Fee can add to your total loan amount, it is still one of the most cost-effective loan programs available—especially since:

- You can finance 100% of the purchase price

- There’s no monthly PMI, even with zero down

- VA rates are often lower than Conventional and FHA loans

- Exempt Veterans pay no funding fee at all, saving thousands

Understanding how the funding fee works ensures you’re making the most of the benefits your service has earned.

Final Thoughts: You Don’t Have to Navigate This Alone

As a retired Army Veteran and military relocation specialist, I’ve helped countless military families, first-time buyers, and PCS clients use their VA benefits the right way. Whether you’re buying your first home, upgrading, downsizing, or thinking about refinancing, I’m here to walk you through every step—including your exact VA Funding Fee calculation.

Have questions about your VA benefit or want to get pre-approved?

Reach out anytime. Your service deserves a seamless, informed homebuying experience.

Categories

Recent Posts