VA Loan vs. FHA Loan: What Military Families Should Know

For military families—whether you’re active duty, reserves, National Guard, or a veteran—the decision to buy a home is deeply personal. You want stability, community, and a place where your family can feel grounded. But when it’s time to choose a home loan, two options often rise to the top: the VA loan and the FHA loan.

Both are powerful lending programs backed by the government, but they differ in cost, benefits, and long-term financial impact. As a retired Army veteran and San Antonio real estate agent who specializes in military relocation and VA buyers, I’m breaking down what you really need to know before choosing your financing path.

What Is a VA Loan?

A VA loan is a mortgage guaranteed by the U.S. Department of Veterans Affairs. It’s designed exclusively for qualifying service members, veterans, and surviving spouses.

Key Benefits of a VA Loan

- No down payment required (0% down for most buyers)

- No private mortgage insurance (PMI)

- Lower average interest rates

- More flexible credit requirements

- Ability to reuse your VA loan benefit

- Option to assume or offer an assumable loan (a major advantage in today’s rate environment)

For military families, this loan often provides the most affordable path to homeownership.

What Is an FHA Loan?

An FHA loan is backed by the Federal Housing Administration and is designed to help buyers with lower credit scores or limited savings.

Key Features of an FHA Loan

- Down payment as low as 3.5%

- Credit scores can be as low as 580

- More lenient debt-to-income ratio rules

- Mortgage insurance required

Even though FHA loans aren’t exclusive to military families, they remain a popular option for buyers who may not qualify for the VA loan—or those who want to preserve their VA entitlement.

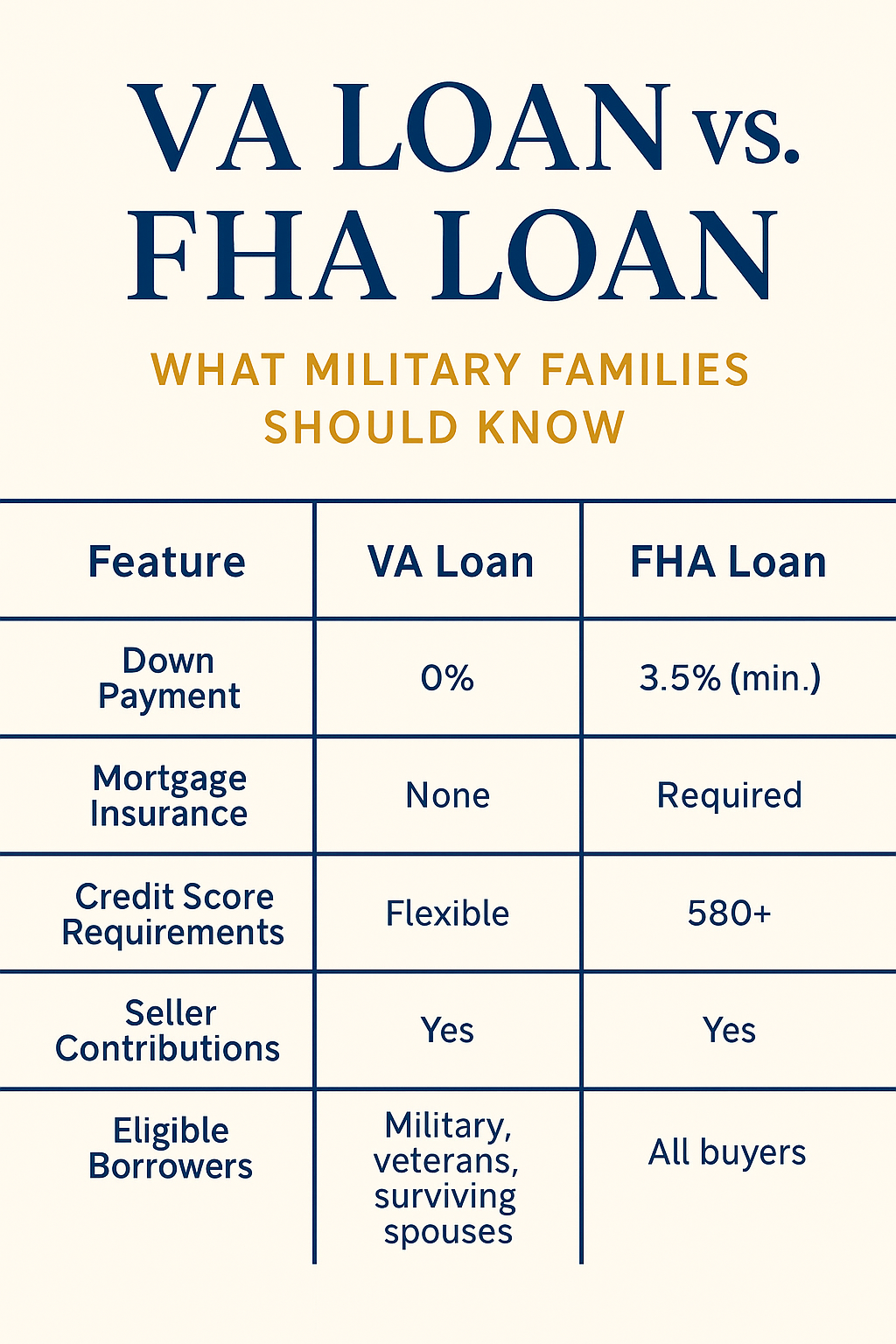

VA Loan vs. FHA Loan: Side-by-Side Comparison

|

Feature |

VA Loan |

FHA Loan |

|

Down Payment |

0% |

3.5% (min.) |

|

Mortgage Insurance |

None |

Required (MIP) |

|

Credit Score Requirement |

Flexible (typically 580–620) |

580+ |

|

Upfront Funding Fee |

Yes (can be financed; waived for disabled veterans) |

Yes (UFMIP) |

|

Interest Rates |

Generally lower |

Typically higher |

|

Eligible Borrowers |

Military, veterans, surviving spouses |

All buyers |

|

Seller Contributions Allowed? |

Yes |

Yes |

Which Loan Is Better for Military Families?

For most military buyers, the VA loan is the strongest financial choice because it eliminates both the down payment and mortgage insurance—two of the biggest barriers for homebuyers.

When a VA Loan Is Typically Better

- You want to keep more cash in your pocket

- You prefer a lower monthly payment

- You’re planning to take advantage of the VA’s no-PMI benefit

- You qualify for the funding fee exemption

When an FHA Loan Might Make Sense

- You don’t currently meet the VA’s service requirements

- Your credit or DTI profile fits the FHA guidelines better

- You want to save your VA entitlement for a different property

- You plan to buy a multifamily property (2–4 units) with flexible FHA guidelines

Special Considerations for Military Families PCSing to Texas

San Antonio is one of the top military relocation hubs in the country, with families transferring to JBSA-Fort Sam Houston, Lackland AFB, Randolph AFB, Camp Bullis, and surrounding bases. VA loans are especially powerful here because:

- You can use your BAH to cover housing expenses.

- You can buy with $0 down and keep cash flexible for PCS needs.

- VA-approved appraisers and lenders are familiar with Texas property standards.

- Assumable VA loans can help you buy a home with a low interest rate if the seller has one.

How Monthly Payments Compare

Here’s a simplified example for a $350,000 home:

VA Loan

- Down payment: $0

- PMI: $0

- Interest Rate: Lower

- Monthly Payment: Lower overall

FHA Loan

- Down payment: $12,250 (3.5%)

- Mortgage Insurance: Required for 11 years or the life of the loan

- Monthly Payment: Higher

For most military families, that PMI difference alone makes the VA loan the more affordable option.

Final Thoughts

Both the VA loan and FHA loan are strong tools that open the door to homeownership, but the right choice depends on your goals, financial profile, and long-term plans.

As someone who served nearly 28 years in the U.S. Army and now helps military families relocate to and across San Antonio, I’m here to guide you through the process with honesty, clarity, and expert insight into VA benefits.

If you’re preparing to buy in Texas—or just need help comparing your options—reach out. Your home is more than a purchase; it’s your next mission.

Ready to explore your loan options? Let’s talk.

Categories

Recent Posts